With the super-deduction set to end on 31 March 2023 there is set to be lots of activity to ensure capital investments are made before this date to make the most of the 130% temporary relief - but will all taxpayers benefit equally?

For accounting periods that end between 31 March 2023 and 31 March 2024 there are two interacting rate changes that will affect the effective rate of tax saving realised as a result of the super-deduction;

- the corporation tax rate is increasing from 19% to 25%, and

- the relief available for expenditure qualifying for the super-deduction tapers down from 130%.

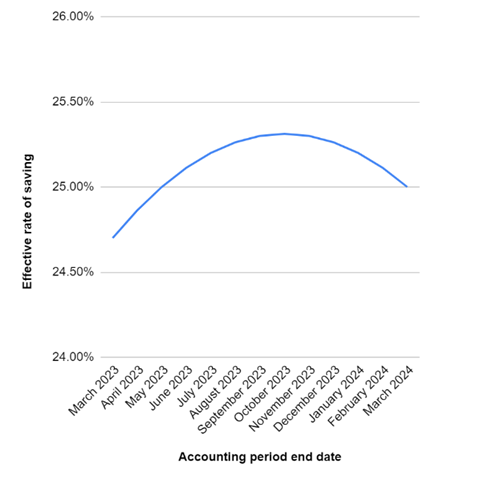

Your first instinct might be that this would mean the effective rate of saving would gradually increase from 24.7% (being 19% x 130%) for an accounting period ending 31 March 2023 towards 25% for an accounting period ending just before 31 March 2024 but the maths tells a different story.

To illustrate (for 12 month accounting periods) this let's take x as the number of months in an accounting period that fall before 1 April 2023 - e.g. for the year ended 31 May 2023, x would be 10.

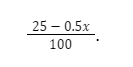

The hybrid corporate tax rate that should be applied to profits arising in that period can then be expressed as:

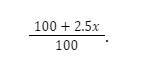

Similarly the tapered rate for expenditure qualifying for the super-deduction can be approximated as (this is based on months whereas the legislation strictly requires calculation in days):

If we were to illustrate these formulas graphically, they would both be straight lines.

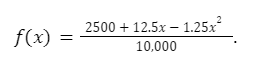

To find the effective rate of tax saving for the super-deduction for a given accounting period we must multiply the rate of relief for the super-deduction by the corporation tax rate. Multiplying the equations above and simplifying the result, the formula for the effective rate of saving is:

The graph of a quadratic equation such as this is an “n-shaped” curve and not a straight line - this means there is a maximum and a “sweet spot” where the effective relief through the super-deduction is highest. This is illustrated in the graph below:

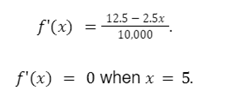

For those really interested in the maths, the maximum is found by differentiating the equation for the effective rate of saving and solving for zero - this results in:

This means the highest effective rate of saving arises when x is 5 i.e. for the year ended 31 October 2023 where the effective rate of saving is 25.31%.

Compared to the year ended 31 March 2023 when the effective rate of saving is lowest a business incurring qualifying expenditure of £10m would be £61,250 better off just by having a different year end.

Whilst changing an accounting period is unlikely to be desirable and not always easy or commercial (and varying the accounting period length will alter the effective rate of saving calculation), there are still actions businesses may be considering when determining how to make full use of the super-deductions available to them before 31 March 2023; especially around the timing of expenditure; this is discussed in more detail here.