On 11 July 2019, the UK tax authorities published draft legislation and draft guidance for a digital services tax (DST) to begin from 1 April 2020. These are available for public consultation until 5 September 2019.

The DST is expected to apply by default at 2% of deemed UK revenues derived in excess of £25m, where the group's total global revenues from in-scope activities exceed £500m. In-scope activities are those that are derived in connection with providing users with search engine, online marketplace, or social media services, and includes revenues from associated advertising businesses. Thus UK revenues in scope are those linked to UK users but may not be derived from UK sources, and complex allocations may need to be performed by businesses conducting in-scope activities. A safe-harbour exists and lowers the 2% rate where applicable.

The definitions included in the legislation and guidance differ from the government’s November 2018 consultation, and could include activities of businesses that do not consider themselves pure search engine, marketplace, or social media platforms.

In detail

In-scope activities

Any business undertaking any of the three in scope activities detailed below will be in scope of DST if the global and UK deemed revenues for those activities (plus revenues from associated advertising businesses, which in isolation would not be included) exceed thresholds of £500m and £25m respectively across the business’ group.

A business won’t be affected unless it carries on one of the relevant activities in a substantive commercial way. If it carries on one of those activities merely incidentally to another activity nor would that bring the company within the provisions.

In considering whether a company activity matches a feature of the online marketplace or social media categories, that feature must be a main purpose (the main purpose or one of the main purposes) of what the company is doing.

The activities in scope are:

- Social media activity - defined to include a platform that:

- promotes interaction between users (including via content provided by other users); and

- enables content to be shared with other users/ groups of users

- Search engine activity - not defined but should be considered to only cover activity that allows users to search the internet (i.e. search for content outside of the website itself),

- Online marketplace - defined to include activity that:

- facilitates the sale by users of particular ‘things’ (broadly defined, and includes the sale of services, goods, or other property)

- enables users to sell particular things on the platform to other users, or

- advertises or otherwise offers to other users particular things for sale

There is an exclusion for online financial marketplaces provided by certain regulated companies if more than half of the relevant revenues arise in connection with the provider’s facilitation of the trading or creation of financial assets.However, this may not apply to companies in the group that do not benefit from regulatory approval or whose financial assets are not considered such by their relevant accounting standards.

A listings marketplace - which while not allowing for direct exchanges on the website is set up with the primary purpose of facilitating such exchanges - is regarded as within scope. A website that displays adverts of third party goods/ services is not within scope.

Observations:

Internet search engine is not defined, unlike in the November 2018 consultation. Website is also not defined. This may cause challenges for businesses operating multiple different websites that are linked to each other in determining whether they meet the criteria, especially in the absence of a main purpose test..

For online marketplaces, key factors HMRC will take into account in determining the main purposes will include the users’ intentions when visiting the platform, the ability to search/filter, and whether facilitating underlying sales is an important part of the platform’s strategy. Accordingly, displaying third party adverts (e.g. banner ads) is not expected to be sufficient.

Film/ music streaming and multiplayer options within online video games would not ordinarily be expected to fall in scope in isolation (a complete exclusion was suggested in the November 2018 consultation). However, many such platforms also offer complementary activities (e.g. associated online communities or “in-game” marketplaces) that could - if they were one of the “main purposes” of the platform - bring revenues within scope. Many businesses will need to determine and evidence the extent of such complementary activities to identify whether they meet the main purpose test.

Revenues in scope and UK allocation

If a platform’s activities are within scope, it will be key for them to identify the revenues attributable to these activities globally, and in connection with UK users.

‘Revenues’ are those received in connection with the DST activity. This is intended to be broad, and to capture all monetisation of the activity.

For a social media platform this is most likely to include revenues from advertising, subscriptions/ access fees, or sale of data.

For search engines, this is most likely to include advertising revenues (whether embedded in the search results, or placed on third party websites, or other advertising revenues), and income from the sale of data.

For online marketplaces, the most likely revenue sources will include commissions, other fees charged to platform users, advertising income and delivery fees.

Just and reasonable allocations may need to be made between DST activities and other activities. However, revenues from ancillary or incidental services to the DST activity should be regarded as in-scope.

A ‘user’ will be any person who engages with a platform. This includes individuals and a non-natural persons, such as a company, is a user with no intention to look through that person to the beneficial owners etc. Placing advertising on a DST activity platform will not make a person a user for this purpose, but creating pages or profiles on social media platforms may do so.

A ‘UK user’ will be any person it is reasonable to assume is normally located or established in the UK. This will require the use of judgement based on the information available to a company. If there are conflicts a company will be expected to use a balance of evidence approach. Relevant factors may include:

- a physical address

- payment details, or

- place of business (e.g., contractual details).

In determining ‘UK digital service revenues’, a business should seek to assess the revenues generated from an in-scope activity that are attributable to UK users. This would include but is not limited to:

- revenue derived from adverts which are intended to be viewed by UK users (e.g., an intent set out contractually)

- revenue derived from commission fees on transactions involving UK users,

- revenue derived from charging subscription fees to UK users, or

- revenue derived from marketplace activities that relate to the sale or rental of UK land/property.

Companies will have to apportion advertising revenues affecting both UK users and non-UK users on a just and reasonable basis. The draft legislation allows for any necessary apportionment to be done on this basis, but HM Treasury comments that presumptions for certain types of revenue will be considered in consultation in order to make calculating a DST liability more straightforward.

Marketplace transactions that concern the provision of UK land, property and accommodation will be considered UK-linked transactions. Otherwise, marketplace fees etc will be UK revenues if one of the parties to the transaction (other than the platform owner) is a UK user - whether buyer, seller or other user. Where one of the users is not a UK user, but instead a user of a jurisdiction which applies a tax which corresponds to the DST, the revenues from the transaction will be reduced by 50%.

Observations:

Where a platform is in-scope (i.e. where an in-scope activity is being performed), incidental revenues from that platform will not be included.

While many businesses in scope of the UK DST may also be in scope of other countries DSTs (e.g. ,France), there may be some businesses that are in scope of only one, due to differences in thresholds and approach (for example, the French DST targets certain revenue streams, rather than activities).

Businesses in scope of multiple DSTs should note that the allocation of revenues to each country may not be seamless - for example the UK seeks to tax revenues connected to users normally located in the UK, whilst the French DST seeks to tax revenues attributable to users’ interaction with the platform while they are physically located in France.

Thresholds and rates

There are two thresholds below either of which a company will not be exposed to UK DST. Both are determined by reference to global group revenues per annum:

- £500m from in-scope activities (whether UK or non-UK revenues)

- £25m from in-scope UK revenues, an amount that will also act as an allowance so that only any excess is chargeable.

A group will consist of a parent company and all its GAAP consolidated subsidiaries (IAS, US or UK GAAP).

The DST will be, by default, a 2% tax on in-scope UK revenues (bearing in mind the possible 50% reduction or marketplace revenues mentioned above).

A group can make an election to apply instead to any of the three categories of activity a safe harbour or alternative basis for the charge. This election must be made annually.

If a group has two in-scope business activities (e.g., an internet search engine and an online marketplace) it could choose to apply the alternative safe harbour basis of charge to one, both or neither of these activities. The calculation then broadly involves:

- determining a UK group profit margin for each category of activity for that accounting period after including a fair and reasonable share of indirect costs but not interest, non-recurring exceptional items, prior losses nor prior year investment in R&D

- apportioning the £25m allowance pro-rata to each category of activity

- for any election or ‘specified’ category the taxable amount is 0.8 x the operating margin x the net revenues (for any other category of revenues, the taxable amount is 2% of the net revenues)

- the aggregate result or ‘group amount’ is then apportioned to individual group companies according to their contribution to UK digital services revenues.

Example - Safe-harbour application

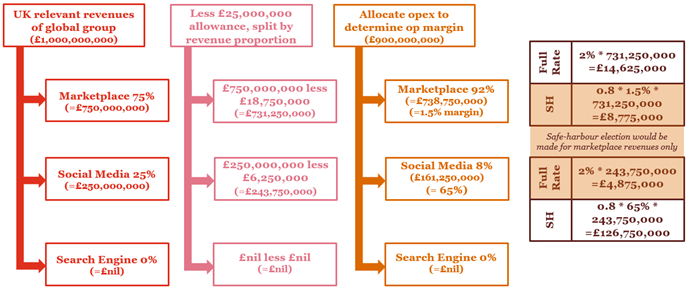

A business operates both an in-scope social media platform and an in scope online marketplace, generating UK relevant revenues of £1 billion and suffering £900 million of allowable operating expenditure. While this implies a 10% margin (and thus implies that the safe harbour would not be favourable), further examination finds that a just and reasonable allocation of revenues and costs between the activities as follows:

- Marketplace: 75% of revenues, 92% of costs

- Social media: 25% of revenues, 8% of costs.

As shown in the diagram below, when the £25 million allowance is allocated on the basis of revenues and profit margins of each activity in isolation calculated, the marketplace activities have a much lower 1.5% margin.

In this example, it would be beneficial for the business to make the safe harbour election only in relation to the marketplace revenues, resulting in total DST due of £13.65 million, rather than the £20 million that would have been due if all revenues were subject to the full 2% rate.

Payment and compliance

DST is calculated with reference to the revenues earned in an accounting period, in line with the group’s financial accounting periods. However, like UK corporation tax rules, if this period exceeds 12 months then this will require two periods of account to be calculated for this purpose instead. The first accounting period begins on 1 April 2020, so most groups will have to calculate a short period from this date to the end of their accounting period for the first year of application, and allocate revenues accordingly.

While every company receiving in scope revenues within the group will be liable and responsible for making payments in relation to that share of the revenue, the ultimate parent of the group must deal with all administration in relation to its group (or nominate and resource another nominated company to do so).

This administration includes:

- Registration within 90 days of the end of the first accounting period where the group has sufficient revenues in scope to be liable for DST payments

- Calculation and submission of returns within 12 months of the end of the first accounting period where the group has sufficient revenues in scope to be liable for DST payments (and subsequent amendments in the following two years)

- Correspondence with HMRC in relation to the group’s DST liabilities.

The nominated company must determine the group’s liability (including through calculation of any reduction due to election of the safe-harbour, and deduction of the £25million allowance). This liability must then be apportioned across group members in proportion with the relevant revenue recognised.

DST will be an allowable expense for UK corporation tax purposes where it would be under normal rules, as described below.

Observations:

Applying normal UK corporation tax rules this will typically mean that the DST is deductible where it was incurred wholly and exclusively for the purposes of the particular trade subject to UK corporation tax. Thus where in-scope revenues are not themselves received by a company subject to UK corporation tax, it is unlikely that another group company would be able to claim a corresponding deduction in the UK (although they may be allowed as business costs in the countries where those companies are subject to tax).

HMRC guidance implies that the allocation of DST liability across group members does not take into account whether the activities of each company benefit from the safe-harbour election. Thus in the example above, the allocation could result in a scenario where all companies in the group with DST activity, not just those with marketplace activity, benefit from the safe-harbour reduction.

The takeaway

The DST is a novel new tax that requires businesses to think about where they digitally interact with other businesses and individuals, not just about where they have physical presence or financial relationships. Businesses that do not consider themselves a social media platform, search engine or online marketplace may undertake some in-scope activities, and will therefore need to carefully consider these rules to ensure that they are compliant.

The UK is clear that it intends to introduce and retain the DST and retain it until an acceptable international agreement is reached on reforming the international corporate tax rules - you can see our bulletin on this here.

Let's talk

If you would like to discuss how these developments may affect your business, please contact: